Andhra Bank Beneficiary cooling period

For security reasons, there is a 3 hour cooling period so the account holder will only be able to make fund transfer to that respective beneficiary 3 hours after adding them. For transactions up to Rs. 5000 per transaction, use AB e-Vyapar, where one can make the transaction without adding a beneficiary.

How to use AB-TEJ ?

Step 1: Download the Andhra Bank (AB-TEJ) from Google Play Store or iOS App Store from the smartphone and then register for the service through the bank.

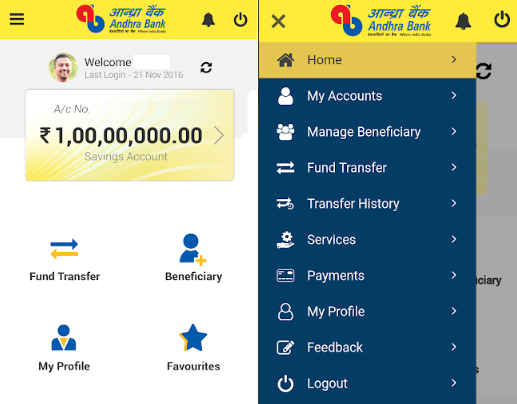

Step 2: After successful installation and validation of the account, one can log in to AB-TEJ App using the credentials.

Step 3: After successful login, one will have access to features like checking the savings account balance, Andhra Bank credit card number and utility bill payments and much more.

Step 4: One can avail various services of Andhra Bank like checking the account balance by clicking on the account balance and further use services like fund transfer, bill pay, recharge and much more by scrolling through the options on the App.

Step 5: Click on ‘Fund Transfer’ to transfer funds to own accounts, within the bank or another bank. Under the ‘Transfer’ option one can also manage the Payee and MMID transfer.

Step 6: To make any payments of utility bills or credit card bills click on ‘Bill Payment’.

Step 7: To recharge cell phones pre-paid number, post-paid mobile number or DTH, click on ‘Recharge’ option.

Step 8: Click on ‘Accounts & Deposits’, Cards and Loans and Forex to check all the details related to savings, loan and deposits accounts.

Step 9: Click on Invest & Insure to invest in stocks, buy sovereign gold bonds or buy life or general insurance.

Step 10: To make transactions through channels like UPI click on the ‘BHIM UPI’ option.

Step 11: To update Aadhaar card, upgrade the Debit Card and for more, click on the ‘Services’ option in the display list of the app.

Step 12: To open a PPF account online click on ‘Online PPF’ at the bottom of the screen of the interface for the app. This process can be completed in a matter of seconds.Andhra Bank Mobile App Features

How to use Andhra Bank Mobile App?

Andhra bank has provided a lot of convenience for its customers by giving them an option to avail Andhra Bank’s various banking services via the customers’ smartphones. Following are some of the features that the customers can enjoy:

- Quick Pay – Customers can transfer amount up to Rs 5000 per transaction to beneficiaries that aren’t added, through Quick Pay

- Deposits online/ closure – Through this option, a customer can open a fixed deposit, make recurring deposits and do reinvestment. Deposits are opened instantly of the selected debit account in the same branch. One needs to enter a request for closure option which is also to close the deposit . It is applicable only for online opened deposits account. The enquiry of all the details of the deposits can be done by this option.

- Standing Instructions – The customers get an option of adding, viewing, modifying or deleting the standing instructions on their primary account or other accounts within Andhra Bank.

- Donation – Customers can donate to various temples listed on the app.

- Government schemes – Customers can avail various government schemes through this app. Customers can check the availability of the government schemes on the app.

Andhra Mobile Banking Advantages

Andhra Bank has provided numerous benefits for its customers. Here are a few of the benefits:

- Customers can make cashless transactions via AB e-Vyapar by merely using their Aadhaar number. The customers do not need a PIN for purchases made via AB e-Vyapar.

- With AB SAFE-T – Andhra Bank Mobile Banking app, the bank has ensured safety for all online transactions.

- The mobile banking services are free of cost.

- Customers can avail various government schemes and insurance policies via the mobile App.